When to Hire a Bookkeeper: Growing Pains That Signal Time for Outsourcing

When to Hire a Bookkeeper: Breaking the 'I Can Do It All' Trap

You built your business on passion, expertise, and sheer determination—not spreadsheets and reconciliations.

Wearing multiple hats? That's just Tuesday for you. Managing every detail personally? That's what got you here.

But here's the truth many growing business owners discover too late: the same drive to control everything becomes your biggest liability as your company scales.

The Reality Behind DIY Bookkeeping

Let's talk numbers.

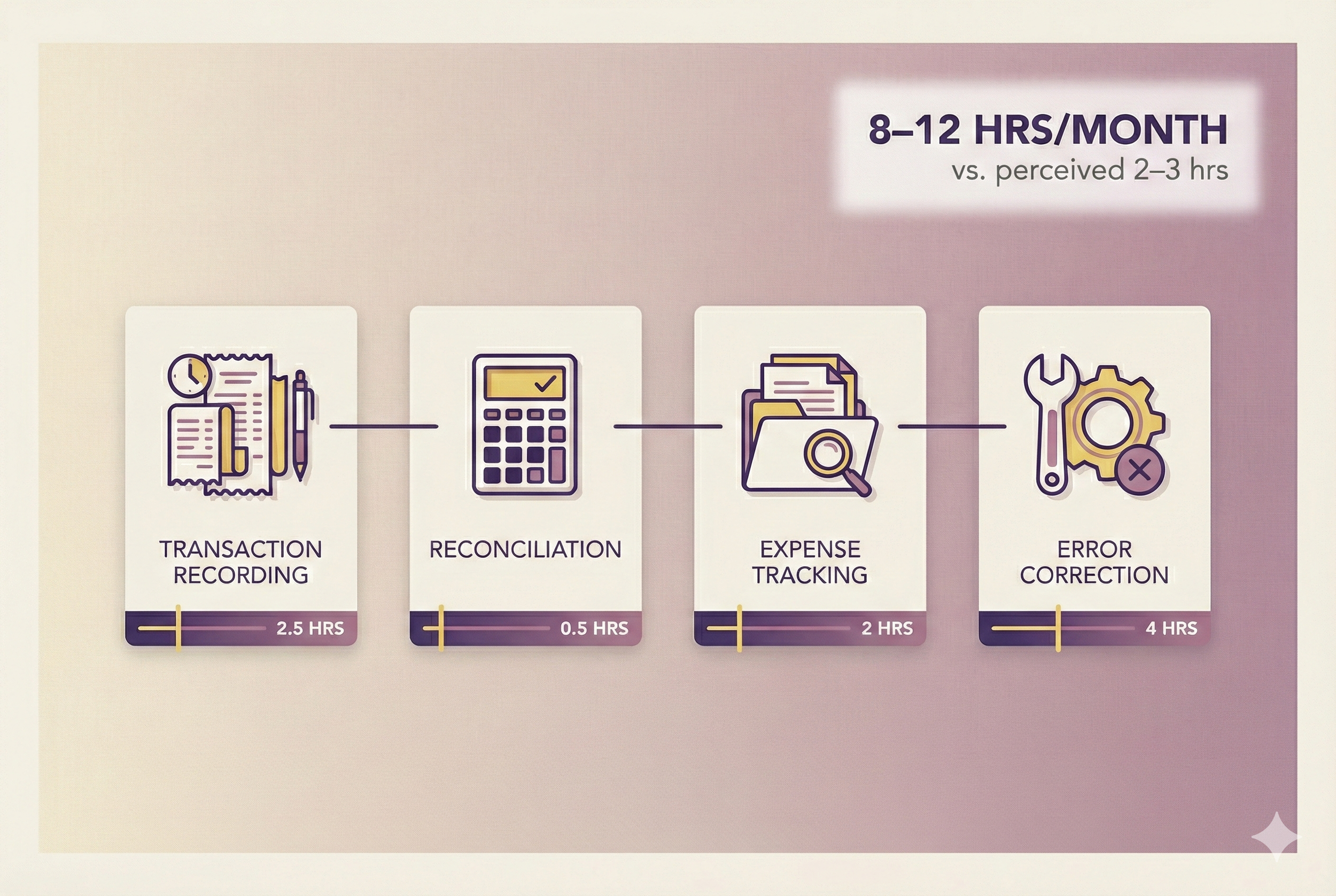

You probably think you're spending 2-3 hours monthly on bookkeeping. Most business owners do. But recent research reveals a startling gap between perception and reality: you're actually spending 8-12 hours monthly when you account for transaction recording, reconciliations, expense tracking, and fixing errors.[1]

That's not a minor discrepancy. That's four times longer than you think—time that compounds month after month, quietly draining your capacity to focus on what truly drives growth.

And here's what makes this critical: DIY bookkeeping creates hidden costs and compliance risks that far outweigh any savings you think you're capturing.[2] The question isn't if you'll need professional help—it's when to hire a bookkeeper to maximize your business potential.

The good news? You're not alone in facing this decision.

50-60% of small businesses now outsource or automate their bookkeeping. You wouldn't be admitting defeat by making the switch—you'd be joining industry leaders making a strategic growth decision.

Your Diagnostic Framework: Seven Warning Signs

This guide explores seven specific growing pains that signal it's time to transition from DIY to professional bookkeeping.

Recognizing these signs isn't failure—it's clarity. It's the moment you acknowledge your business has grown beyond what one person can efficiently manage alongside core operations.

Here are the seven growing pains:

Bookkeeping consumes excessive time that should fuel revenue-generating activities

Financial records are perpetually behind, never caught up

Tax season becomes overwhelming with panic and errors

Recurring mistakes and missed deadlines create compliance risk

Lack of real-time financial visibility limits strategic decision-making

Business complexity outpaces your DIY systems as you scale

Software limitations create bottlenecks in your financial processes

Each signal points to a specific problem—and a clear solution.

As you read through each one, you'll likely see yourself in these scenarios. Experiencing three or more of these pains? The math becomes undeniable: outsourcing bookkeeping delivers measurable ROI within your first year.

Let's explore what each growing pain means for your business—and when it's time to make the shift to professional support.

The Hidden Cost of DIY Bookkeeping: Your Time Is Worth More Than You Think

You built your business on passion and expertise—not accounting. Yet here's the truth many owners discover too late: managing your own bookkeeping costs far more than the price of software or your accountant's fees.

The real expense? The hours you're not spending on what actually drives your business forward.

The most insidious cost of DIY bookkeeping never appears on your profit and loss statement. It's the time consumed by financial administration—time that could fuel revenue growth, strengthen customer relationships, or sharpen your strategic vision. Let's quantify exactly what that's costing you.

The Time Underestimation Gap

Most business owners estimate spending 2–3 hours monthly on bookkeeping tasks.

The reality tells a different story.

When you account for transaction recording, bank and credit card reconciliations, expense tracking, categorization, and error correction, actual time spent averages 8–12 hours per month.[1] That's four to six times what most owners estimate—a staggering gap between perception and reality.

Why the disconnect?

Bookkeeping tasks scatter across your month in deceptively small chunks. Thirty minutes reconciling your bank account on Monday. Forty-five minutes organizing receipts on Wednesday. An hour categorizing expenses on Friday. Each individual task feels manageable. Collectively, they create a significant weekly burden that's surprisingly easy to undercount.

The problem intensifies during tax season and when errors occur. A single bookkeeping mistake can trigger hours of investigation and correction, unraveling your carefully planned week. For business owners already working stretched schedules, this time accumulates silently until you suddenly realize entire workdays vanish into managing financial records.

What Those Hours Actually Cost You

Now let's convert those hidden hours into their true business impact.

At a conservative valuation of $100 per hour of your time—a reasonable estimate for business owners generating $500K–$5M annual revenue—those 8–12 hours monthly translate to $800–$1,200 per month.

Over a year? Approximately $12,000 in lost opportunity cost.[2]

Let that number settle: $12,000 annually in time you're not investing in activities that actually generate revenue.

For a startup founder, every hour trapped in spreadsheets is an hour not spent pitching investors or refining your product. For an e-commerce owner, it's time away from analyzing sales trends or launching new product lines. For a consulting firm owner, it's hours not devoted to client relationships or strategic partnerships that fuel growth.

This isn't theoretical hand-wringing.

Business owners working 60+ hours weekly consistently report that DIY bookkeeping becomes unsustainable, pulling them away from high-value strategic work and accelerating burnout.[2] The administrative overhead transforms from a manageable task into a genuine growth bottleneck.

Where Your Time Actually Disappears

Understanding the specific time-drains helps explain why DIY bookkeeping feels so exhausting.

The biggest culprits:

Organizing receipts – Cited by 35% of business owners as their biggest tax challenge.[3] Receipts scatter across email inboxes, physical envelopes, credit card statements, and digital wallets. Hunting them down, categorizing them, and entering them consumes hours monthly—hours that compound as your transaction volume grows.

Understanding complex tax laws – Tax regulations shift annually, requiring you to research which deductions apply to your business, how quarterly payments work, and what compliance deadlines matter. This research eats time, and mistakes carry real financial consequences.

Identifying eligible deductions – Uncertainty about what qualifies as deductible creates hesitation and second-guessing. You might miss valuable deductions simply because you're unsure, leaving money on the table unnecessarily.

Tracking multi-channel expenses – Between credit cards, bank accounts, mobile payments, and cash transactions, expenses fragment across platforms. Reconciling and consolidating them manually is tedious, error-prone, and remarkably time-intensive.

Manual data entry and reconciliation – Moving information between bank portals, accounting software, spreadsheets, and tax forms requires repetitive data entry. Each step introduces potential errors and consumes time that scales with business growth.

These tasks don't just consume hours—they create decision bottlenecks that ripple through your business.

Falling behind on reconciliations means you lack current financial visibility. Delayed expense categorization clouds profitability analysis. Uncertainty about deductions leaves tax season decisions to last-minute guesswork. Each of these scenarios directly connects to the seven growing pains we'll explore next.

The real question isn't whether you can manage DIY bookkeeping. It's whether you can afford to keep spending $12,000 annually on it when that investment could transform your business growth.

Seven Growing Pains: When DIY Bookkeeping Becomes a Growth Bottleneck

The hidden costs of DIY bookkeeping rarely announce themselves with a single crisis moment.

Instead, they show up as seven recognizable growing pains—warning signs that your financial systems can no longer keep pace with your business needs. When you're experiencing three or more of these simultaneously, you're past the tipping point. The opportunity cost of continuing DIY likely far outweighs the investment in professional services.

Think of this framework as your diagnostic tool. Use it to understand exactly where your business stands and whether it's time to make the switch.

Pain #1: Bookkeeping Consumes More Hours Than Revenue-Generating Activities

When routine financial tasks eat into time that should fuel your business—sales calls, customer engagement, product development, strategic planning—you've crossed a critical line.

This pain hits hardest if you're already working 60+ hour weeks.

Every hour reconciling accounts is an hour you're not connecting with a prospect. Every evening organizing receipts is an evening you're not analyzing customer trends or refining your product strategy. Business owners working full-time consistently find DIY bookkeeping unsustainable, pulling them away from the high-value work only they can do.[2]

Here's the inflection point: When bookkeeping regularly exceeds 4–5 hours per week, outsourcing typically pays for itself within the first year.

If you're spending more than this, you're likely leaving significant revenue opportunities on the table.

Consider Alex, a SaaS founder who realized every hour in spreadsheets was an hour he should have spent pitching investors. Or Maria, an e-commerce owner analyzing week-old sales data instead of identifying real-time trends. Their businesses grew only when they reclaimed this time.

Your signal: If bookkeeping consumes a significant chunk of your weekly schedule, Pain #1 is present.

Pain #2: Financial Records Are Always Behind, Never Caught Up

Falling behind on transaction recording, reconciliations, or expense tracking creates a dangerous situation:

Your financial decisions are based on outdated information.

When records lag by days or weeks, you're operating blind. This delay triggers a cascade effect. You fall behind, which creates stress. Stress leads to rushed, error-prone catch-up work—especially before tax deadlines. That rush introduces mistakes. Those mistakes increase audit risk.

The cycle perpetuates.

Errors require more time to correct, which means falling further behind. When financial closings, invoicing, or payroll processing become consistently delayed, you've lost visibility and control. You can't assess monthly performance accurately. Cash flow becomes opaque. Corrective decisions are made on incomplete information.[2]

Rachel, a retail shop owner, made inventory purchasing decisions based on sales data from two weeks prior. She missed seasonal trends and demand shifts that could have been capitalized on immediately. Her financial records were simply too outdated to guide real-time decisions.

Your signal: When you're perpetually playing catch-up with transaction recording and reconciliations, Pain #2 is active.

Pain #3: Tax Season Panic – Scrambling, Errors, and Missed Deductions

Tax season transforms from routine compliance into an annual crisis for business owners managing their own books.

The emotional weight is real.

37% of small business owners report feeling nervous, fearful, or completely overwhelmed during tax filing time.[3] Only 26% feel completely confident about their taxes—a confidence gap that signals systemic problems, not isolated incidents.

For businesses with fluctuating income, quarterly tax obligations compound the stress. You must estimate and remit quarterly payments without confidence in accuracy. Each quarter brings renewed anxiety: Did I set aside enough? Are my calculations correct?

Canadian businesses face additional complexity. Managing GST, HST, PST, and QST across multiple provinces creates compliance challenges many owners struggle to navigate correctly, increasing penalty risk.[4]

Adding to this burden: 41% of business owners report difficulty keeping up with shifting tax laws, which change annually with new deductions, credits, and filing requirements.[5]

Your signal: If you're scrambling during tax periods, relying on accountants to clean up errors, or consistently missing deductions, Pain #3 is active.

Pain #4: Recurring Errors, Missed Payments, and Growing Compliance Risk

When bookkeeping mistakes become recurring rather than exceptional, you've lost control.

Payroll errors happen quarterly. Vendor payments are frequently late. Tax filing errors require amendments. This isn't a pattern of isolated incidents—it's a signal that your DIY system has fundamental problems.

Visible red flags appear everywhere:

Tax notices arriving unexpectedly

Vendors calling about late payments

Missed customer invoices creating cash flow gaps

Remittances submitted after deadlines

These warnings tell the same story: your record-keeping is no longer reliable.

The financial consequences are substantial. Bookkeeping errors result in average annual penalty costs of $845 for small businesses due to compliance issues.[6] More significantly, incorrect bookkeeping leads to tax overpayments averaging $3,534 per year—money left on the table unnecessarily.

Over a business lifetime, this compounds to tens of thousands in wasted tax dollars.

Worse, compliance issues escalate. Initial penalties trigger audits, which uncover more errors, creating legal exposure and reputational damage that far exceeds the original mistake's cost.

Common DIY mistakes include:

Mixing business and personal funds

Irregular reconciliations

Misclassifying expenses

Delaying record updates until crisis moments force action

Your signal: If you're experiencing recurring errors in payroll, vendor payments, or tax filings, Pain #4 is present.

Pain #5: Not Knowing Your Real Numbers – The Most Dangerous Pain

This is the most dangerous growing pain because it strikes at the heart of survival.

Here's the startling statistic: approximately 82% of small businesses that fail cite poor cash flow management as the primary cause—not insufficient revenue or profit, but inability to manage cash effectively.[7]

The visibility gap is widespread. Only 38% of businesses report having real-time visibility into their cash positions. The rest rely on financial data delayed by days or weeks, operating without the clarity needed to make timely decisions.

Three critical consequences follow from this blindness:

Consequence #1: Business Failure Risk

Over 80% of small business failures stem from poor cash flow oversight—many of them profitable businesses that simply ran out of accessible cash reserves at critical moments.

The paradox is stunning: you can be profitable and still fail if you can't cover payroll or supplier obligations.

Consequence #2: Delayed Problem Detection

Without real-time warning, late customer payments, rising operational costs, or seasonal downturns escalate into crises. By the time you realize the problem, it's already become a payroll shortfall or missed supplier payment—situations that could have been prevented with early visibility.

Consequence #3: Strategic Impairment

Lack of accurate financial data prevents confident decision-making about scaling, hiring, investment, or resource allocation. Strategic planning becomes reactive rather than proactive.

You're fighting fires instead of building your future.

Many businesses resort to expensive credit lines or factoring services as emergency solutions rather than strategic tools—a costly band-aid that wouldn't be necessary with proper financial visibility.

Consider Javier, a consulting firm owner who needed project profitability insights but couldn't generate them. Or Chris, a landscape company owner who struggled to allocate labor costs per job, making bids based on guesswork rather than data.

Your signal: If you don't know your cash position without checking multiple accounts, or if you're surprised by financial shortfalls, Pain #5 is present.

Pain #6: Growing Complexity – Scaling Faster Than Your DIY Systems Can Handle

Your business is growing, which is exciting.

But your DIY bookkeeping systems can't scale at the same pace. What worked for five clients and one revenue stream breaks down with 50 clients and five revenue streams.

Growth creates specific tipping points that overwhelm DIY operations. Multi-channel sales—e-commerce, retail, and wholesale simultaneously—require tracking sophistication your current system wasn't designed for. As transaction volumes and complexity expand, existing DIY systems buckle under pressure.[8]

Error rates climb as each new channel multiplies tracking complexity exponentially.

New revenue streams introduce specialized accounting requirements. Subscriptions, international sales, marketplace channels, or licensing models all require knowledge that DIY systems and general software can't accommodate. Your bookkeeping approach was built for Product A sold domestically; it wasn't designed for Product A + Service B + Subscription C sold across three countries.

Resource constraints compound during growth. The slow, costly process of hiring and training in-house bookkeepers creates gaps exactly when complexity peaks. You're understaffed precisely when you need the most support.

There's also a strategic requirement: if expansion, investor attraction, or loan applications are planned, professional-grade financials are often required for due diligence. DIY books rarely meet these standards, delaying or preventing growth opportunities.

Your signal: When new products, revenue streams, or employee growth outpace your financial system's ability to track them accurately, Pain #6 is present.

Pain #7: Software Bottlenecks – When QuickBooks and Spreadsheets Can't Scale

You invested in QuickBooks expecting it to solve your bookkeeping challenges.

But as your business grows, the software itself becomes a bottleneck rather than a solution.

QuickBooks presents major limitations for growing businesses.[9] The technical constraints are real: QuickBooks Online restricts simultaneous users to approximately 25, while Enterprise version maxes out around 40. Large transaction volumes cause file slowdowns and crashes, especially during month-end close when you need the system most.

Automation gaps force manual workarounds. Without system integration, you're re-entering data across platforms constantly. Sales data from Shopify, payment data from Stripe, expense data from credit cards—all require manual reconciliation and entry. As data volumes grow, this manual work becomes error-prone and time-consuming.

Reporting limitations emerge as revenue streams diversify. QuickBooks' generic reporting can't provide the granular profitability insights needed for strategic decisions. You can't answer critical questions:

Which product line is most profitable?

Which customer segment generates the best margins?

Which project is overrunning budget?

For specialized businesses—professional services firms, consultancies, creative agencies—QuickBooks fails spectacularly. It can't handle recurring revenue tracking, project-based costing, or milestone-based revenue recognition. Workarounds introduce errors that compound over time.

Basic versions even allow users to edit data freely, compromising audit trails and financial integrity. This flexibility that felt helpful in early stages becomes a liability when compliance matters.

Your signal: When month-end close is delayed, data doesn't align between systems, or you can't generate required reports for decision-making, Pain #7 is active.

Recognizing Your Situation

These seven growing pains often appear together, creating a perfect storm of financial management challenges.

Some business owners experience all seven simultaneously. Others recognize three or four that resonate deeply.

Here's what matters: if you recognize even three of these signals in your business, the opportunity cost of continuing DIY almost certainly far outweighs the investment in professional services. Your business has grown beyond what spreadsheets and part-time effort can effectively manage.

Recognizing these pain points isn't failure.

It's the moment you stop trying to do everything yourself and make the strategic decision to focus on what only you can do—building and growing your business.

Adding It Up—The True Financial Cost of DIY Bookkeeping

You've walked through the seven growing pains that reveal when DIY bookkeeping shifts from manageable task to business liability. But here's what catches most business owners by surprise: these costs don't sit quietly in separate corners of your financial life.

They accumulate. They multiply. They compound in ways that never show up cleanly on your profit and loss statement.

Let's bring them into the light.

The Real Numbers Behind DIY Bookkeeping

When you add up the direct penalties, the tax dollars you've overpaid, and the opportunity cost of your time, the annual impact becomes impossible to ignore.

Here's what the research reveals:

Average annual penalties from compliance errors: $845[10]

Average annual tax overpayments from mistakes: $3,534[6]

Lost opportunity cost from your time: $12,000 annually (based on 8–12 hours monthly at $100/hour)

Total Annual Cost: Approximately $16,379

And that's just what you can measure. This figure doesn't capture the stress that builds every tax season, the sleep you lose during financial crises, or the growth opportunities that slip away while your attention stays trapped in spreadsheets.

Why These Costs Keep Growing

Here's what makes DIY bookkeeping truly expensive: mistakes don't stay small.

They snowball.

That expense you misclassified in January? It creates a discrepancy in February's reconciliation. By tax time, that single error has woven itself through months of records, demanding hours of forensic accounting to untangle. The cost to fix it in year three—after it's embedded in multiple tax filings and financial reports—grows exponentially higher than catching it immediately would have been.

Beyond the direct penalties, these cascading errors distort your entire financial picture. When your books can't be trusted, every decision suffers:

You make inventory decisions based on incomplete sales data

You hesitate to hire because you're unsure of your actual cash position

You pass on growth opportunities because your finances are too murky to justify the investment with confidence

Each impaired decision multiplies downstream costs. Missed market windows. Poorly-timed hiring that creates inefficiency. Capital allocated to the wrong priorities. These strategic consequences dwarf the direct penalties you see in tax notices.

The Question That Changes Everything

The real question isn't "Can I afford to outsource my bookkeeping?"

It's "Can I afford not to?"

When you total the direct costs ($16,379 annually), add the compounding effect of accumulated errors, and factor in the strategic consequences of making decisions with cloudy financial data, the burden becomes clear.

For most growing businesses, this cost far exceeds the investment in professional services—which we'll explore in the next section.

Making the Switch—The ROI of Professional Bookkeeping Services

You've identified the growing pains. You've calculated the hidden costs. Now comes the strategic question: What's the actual financial case for outsourcing?

The answer is clearer than you might expect—and it likely favors professional bookkeeping by a significant margin.

The Three-Way Cost Comparison

When evaluating the true cost of bookkeeping, most growing businesses discover that outsourcing offers the optimal balance of cost, accuracy, and scalability.

Here's how the three main options stack up:

DIY Bookkeeping: $0–$50/month

Software cost only (QuickBooks, Wave, or spreadsheets)

Excludes your time value (~$12,000/year at $100/hour)

High error risk and compliance uncertainty

No professional accountability or audit trail

Outsourced Bookkeeping: $179–$500/month (~$2,148–$6,000/year)

Flat-rate packages that scale with business growth

Includes dedicated expert support and accuracy guarantees

Compliance built-in with audit-ready records

Saves $12,000–$15,000 annually versus in-house staff[11]

In-House Bookkeeper: ~$45,000/year

Salary plus benefits (health insurance, payroll taxes, equipment)

Fixed cost with limited flexibility as workload fluctuates

Requires hiring, training, and ongoing management

Turnover creates gaps during busy seasons or departures

The comparison reveals an immediate insight: outsourcing costs significantly less than hiring an in-house employee while typically delivering superior accuracy and compliance.

Financial Savings & Error Avoidance

The cost savings go deeper than monthly fees.

When you switch to professional bookkeeping, you avoid multiple categories of expense:

Direct Salary Savings

Outsourcing saves $39,000–$42,000 annually compared to a full-time in-house bookkeeper salary and benefits package.

Error Avoidance

Professional services typically prevent $5,000+ in annual penalties and overpayments that plague DIY approaches.[12]

Bookkeeping errors result in average annual penalty costs of $845, while incorrect categorization leads to tax overpayments averaging $3,534 per year. Professional bookkeepers catch these issues before they become costly compliance problems.

Accuracy & Compliance

Professional services eliminate the audit risk and potential penalties that come with DIY record-keeping gaps. One audit exposure alone can cost thousands in legal fees and stress.

Total Potential Savings

When combined, total annual savings from switching to outsourced bookkeeping can exceed $20,000 for many growing businesses.

For a business spending 4–5 hours weekly on bookkeeping, this translates to positive ROI within the first three months.

Efficiency Gains & Time Recapture

Beyond the financial metrics lies an often-underestimated benefit: your time back.

Studies show outsourced bookkeeping saves 30–75% compared to hiring an in-house employee while delivering superior accuracy, better compliance, and more strategic financial insights.[13] You get more value per dollar invested.

Reclaim 10–20 hours monthly previously consumed by transaction recording, reconciliations, expense categorization, and error correction.

That's 120–240 hours annually—time you can redirect to activities that actually drive revenue:

Sales calls

Customer relationships

Product development

Strategic planning

For a startup founder, those hours translate to investor pitches. For an e-commerce owner, they mean analyzing sales trends and optimizing marketing spend. For a consulting firm owner, they represent client relationship-building and new business development.

Imagine your typical week without Sunday nights organizing receipts. Without tax season panic. Without manual reconciliation work consuming your attention.

Instead: clarity, accuracy, and your energy directed toward what you built your business to do.

The Break-Even Threshold & ROI Timeline

Here's the decision metric that matters:

Once bookkeeping tasks regularly exceed 4–5 hours per week or your business complexity increases significantly, outsourcing delivers positive ROI within the first year—often within the first quarter.

The math is straightforward.

At $100/hour owner time valuation, 5 hours weekly equals $26,000 annually. Professional bookkeeping at $300/month costs $3,600/year. The cost-benefit isn't even close.

But the decision isn't purely financial. It's about strategic allocation of your most valuable resource: your time.

The investment pays off when the owner's time is better spent on high-value activities where their unique contribution generates returns that far exceed the bookkeeping cost.

This isn't cost-cutting. It's strategic resource allocation.

And for nearly every growing business, the math is clear: outsourcing is the financially and strategically sound decision.

The question isn't whether you can afford to outsource your bookkeeping.

The real question is: Can you afford not to?

And as you'll see next, you're far from alone in making this choice.

Industry Trends—Why 50-60% of Small Businesses Now Outsource

Here's the truth: you're not pioneering some unconventional path by considering professional bookkeeping. You're actually joining the majority of growth-focused businesses who've already made this strategic move.

The Market Has Already Decided

Over half of all small businesses now outsource or automate parts of their bookkeeping.[14]

Let that sink in for a moment. Between 50-60% of small businesses have shifted from DIY to professional services. This isn't a niche strategy reserved for Fortune 500 companies—it's become the standard operating procedure for successful, scaling businesses just like yours.

What does this mean for you? Your competitors have likely already freed themselves from spreadsheet stress. They're making faster decisions, moving with agility, and reinvesting their time into revenue-generating activities. The real question isn't whether outsourcing bookkeeping is legitimate anymore—it's whether you can afford to remain in the shrinking minority still managing everything alone.

Technology Changed Everything

Why has bookkeeping outsourcing adoption accelerated so dramatically in recent years?

Cloud-based financial tools and expert service providers have transformed professional bookkeeping from a luxury into an accessible, affordable solution. What once required hiring a full-time in-house employee—something only large enterprises could justify—is now a practical option for any growing business.

The barrier to entry has never been lower.

Whether you're a bootstrapped startup founder or an established small-to-medium enterprise, professional bookkeeping services are within your reach. Technology has democratized access to expert financial management, enabling you to outsource earlier in your lifecycle and at a fraction of the historical cost.

Focus Creates Competitive Advantage

Businesses that outsource their financial tasks don't just save money—they gain a measurable competitive edge.[15]

By freeing leadership from bookkeeping, these companies can focus intensely on what truly drives growth:

Innovation and product development

Market expansion and customer acquisition

Strategic relationships and partnerships

Revenue-generating activities

In competitive markets, the ability to move faster and respond to opportunities immediately is a tangible advantage. Your competitors who've made the switch aren't reconciling bank statements at 9 PM or scrambling through tax season. They're building their businesses while you're buried in spreadsheets.

Outsourcing isn't about cutting corners—it's about winning through focus.

Industry best practices for 2025 make it clear: outsourcing and automation aren't optional add-ons anymore. They're essential infrastructure for scaling.[16]

With industry trends validating the decision, clear financial justification backing the math, and proven competitive advantages rewarding the move, the real question isn't whether to outsource.

It's when you'll make the shift.

Your Opportunity to Reclaim Your Time and Get Back to What You Do Best

You've walked through seven distinct warning signs—each one telling you that DIY bookkeeping has shifted from a smart cost-saving measure to a serious growth constraint.

If even three of these scenarios felt familiar, you're in good company.

More importantly, you now have the clarity to make a strategic decision about when to hire a bookkeeper.

The Seven Pains You've Recognized

Let's recap what you've discovered:

Bookkeeping consuming more hours than revenue-generating activities

Financial records perpetually behind schedule

Tax season triggering panic and scrambling

Recurring errors and missed deadlines

Zero real-time visibility into your financial position

Business complexity outpacing your DIY systems

Software bottlenecks preventing growth

Here's the thing: these aren't signs of failure.

They're signs of success.

Your business has grown beyond the point where DIY financial management works. That's actually a victory worth celebrating—and a clear signal it's time for professional bookkeeping services.

Why This Is a Strategic Growth Decision

Recognizing the need for expert help isn't an admission that you can't do it all.

It's strategic clarity.

You're joining the 50–60% of small businesses that now outsource or automate their bookkeeping.[14] These aren't struggling companies cutting corners—they're growth-focused businesses that understand a simple truth:

Outsourcing bookkeeping isn't cost-cutting; it's investment in growth.

Industry leaders recognize that the real question isn't "Can I do this myself?" It's "Can my business afford for me to be doing this instead of what only I can do?"

The answer is almost always no.

Your genius—your time, strategic thinking, and relationships—belongs on activities that drive revenue and build your vision. Not reconciling bank statements.

The Peace of Mind Professional Bookkeeping Delivers

Imagine what changes when you make this shift:

Tax season without panic. No scrambling through receipts on April 14th. No relying on your accountant to fix preventable errors. Just organized, compliant records ready for filing.

Financial clarity instead of guesswork. Real-time visibility into your cash position. Instant awareness of trends—falling sales, delayed payments, rising costs. Data-driven decisions replacing educated guesses.

Time reclaimed for what you love. Hours each week freed from spreadsheets and reconciliations. Time redirected toward sales calls, customer relationships, product innovation, strategic planning—the activities that actually drive your business forward.

Confidence in your numbers. Peace of mind knowing your financials are accurate, compliant, and working for you. Better sleep at night.

Support for your growth. A financial partner who understands your business, anticipates challenges, and helps you scale without financial chaos.

This is the transformation that happens when you partner with expert bookkeepers who specialize in tailored financial solutions designed specifically for your business.

Your Next Step: Get Started Today

You built your business to follow your passion, not to become a part-time accountant.

Frances Financial Solutions specializes in tailored financial solutions—bookkeeping, finance management, and payroll services—designed to give you clarity, confidence, and peace of mind.

We listen to your unique needs and create customized systems that fit how you work. Not forcing you into a one-size-fits-all mold.

The question isn't whether you can afford to outsource your bookkeeping.

It's whether you can afford not to.

Your time, your energy, and your business growth depend on making this transition at exactly the right moment.

That moment is now.

Ready to reclaim your time and accelerate your growth?

Schedule a complimentary, no-pressure 20-minute consultation with us.

We'll listen to your specific financial challenges, walk you through exactly how our services work, and show you precisely how much time and money you could reclaim.

There's no obligation—just expert guidance and the clarity you need to move forward with confidence.

Citations

The Hidden Costs of DIY Bookkeeping for Growing Businesses, Accounting Department, 2023-2025

2025 Small Business Tax Trends: Procrastinator or Planner, FreshBooks, 2025

Challenges of Sales Tax for Small Businesses, Kintsugi, 2023-2025

Tax Season Stress for Small Business, CO Countant, 2024-2025

Why Bookkeeping Errors Cost Small Businesses Thousands, Bay Area Accounting Solutions, 2023-2025

Top Cash Flow Problems and How to Avoid Them, LivePlan, 2024-2025

How Outsourced Bookkeeping Helps Scale Operations, Phoenix Strategy Group, 2023-2025

Signs Your Business Has Outgrown QuickBooks, Centre Technologies, 2023-2025

The Hidden Costs of DIY Bookkeeping No One Talks About, Accounting Freedom, 2023-2025

Evaluating the ROI of Outsourcing Bookkeeping Services, Less Accounting, 2023-2025

The Benefits of Outsourcing Your Bookkeeping vs DIY, Fat Cat Bookkeeping, 2023-2025

Accounting and Bookkeeping Statistics, DocuClipper, 2023-2025

Accounting Trends Small Businesses, The Ledger Labs, 2024-2025

Bookkeeping Best Practices for Small Businesses in 2025, Pivot Solutions, 2025